But how Horizon Capital’s overdue exit from the asset affected its value

“We are not commenting at the moment,” answered the founder, chief executive officer of Horizon Capital, Olena Kosharna, to Mind’s question about the closing date of the Datagrup-Volia sale agreement. The publication received similar answers to a wider list of questions from the press service of the “object of sale” and the founder and former shareholder of “Datagroup” Oleksandr Kardakov. Meanwhile, rumors about a change in the owner of the asset have been “walking” on the market for almost a month. However, their confirmation was recently provided only by the AMCU: the committee is considering the application of the French NJJ Capital regarding the purchase of not only lifecell, but also Datagroup-Volia. The deal can be in the top of the biggest in 2024. Mind tells the details.

“Upgrade” of the asset. Horizon Capital entered the capital of Datagroup back in 2010, buying out a minority stake. In 2016, it became the majority shareholder. In 2020, it increased its share from 73.46% to 96.13%. The remaining 3.87% of the shares are owned by Mykhailo Shelemba, CEO of Datagroup. As a result of that agreement, the founder of the company Oleksandr Kardakov and other minority investors completely left the shareholders.

The amount of the three rounds was not disclosed. However, it is interesting that, contrary to the logic of investment funds, the company continued to invest. “Horizon Capital, like other investment companies, develops according to the logic of funds. It has long overdue its scheduled exit,” explains telecom expert Anatoliy Frolenkov. That is, she had to get rid of her stake in Datagroup back in 2014.

But the beginning of Russia’s war against Ukraine made adjustments. “Probably fortunately, Horizon Capital did not sell a minority stake in 2014. Currently, Datagroup is in the stage of business transformation and optimization. I believe that we still have a reserve for increasing the efficiency and value of the company,” Mykhailo Shelemba told Mind in 2019 .

“Since Horizon Capital received operational control, Datagroup has completed a complete transformation of the business, reducing the ratio of net debt to EBITDA by 9 times to a low level of 0.3 and providing more than 20% average annual growth of EBITDA”, – already in 2020 it was reported in Horizon Capital.

At the same time, starting in 2017, Datagroup began buying up small regional Internet providers. In 2021, it announced the acquisition of the Volia group of companies with the support of the EEGF II Horizon Capital fund. According to officially unconfirmed information, the amount of the deal was $45 million.

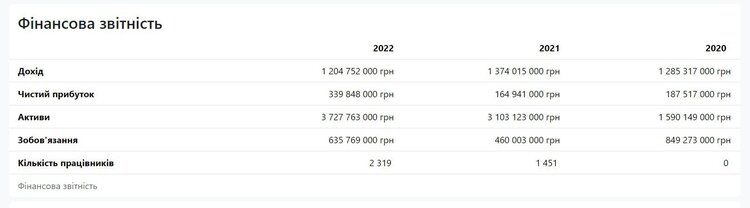

The company ended 2022 with a total turnover of UAH 3.14 billion and a net profit of UAH 522.6 million.

Dynamics of financial results of “Datagroup”

Source: https://opendatabot.ua/c/31720260

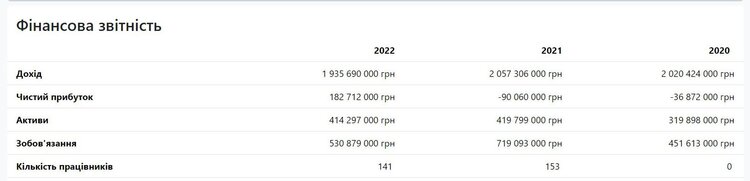

Dynamics of Volia’s financial results

Source: https://opendatabot.ua/c/30777913

As a result, a united and rather unique asset is now for sale: in Ukraine, there are approximately 3,000 players in the fixed-line Internet market (FSHSD), among them “Datagroup-Volia” – the only national operator with strong positions in both B2B and B2C. “Datagroup” is #1 among FSSD operators in the corporate and wholesale segments with a market share of over 50%. Clients include almost 200 large Ukrainian companies and 93% of Ukrainian banks. And Volia is among the top five in B2C. In 2020, the company had almost 677,000 subscribers . “Currently, Datagroup-Volia does not disclose the exact number of B2C subscribers, but it is definitely more than that of Vodafone Ukraine after the purchase of Vega and Freenet,” says telecom expert Oleksandr Glushchenko.

Why this asset to the French? Earlier, experts told Mind that billionaire Xavier Niel’s NJJ Capital is interested in strengthening the position of lifecell through the purchase of fixed-line Internet operators. “This mobile operator never became the second in the market. In order to develop further, you need to invest in FSSD. “Kyivstar” has approximately 1 million subscribers, “Vodafone Ukraine” after the acquisition of Vega and “Freenet” has several hundreds of thousands, and lifecell has zero subscribers, Oleksandr Glushchenko explained.

Now he adds that lifecell with the backbone capacities of “Datagroup” (more than 20,000 km of them) will be able to quickly build networks in any city of Ukraine. “I think that in 2025 – after the integration of assets – the FSSD market will face hellish competition for paying subscribers. In the city of small providers, I would have already tensed up and thought not about dumping, promotions and pacifier subscribers, but about the money that is needed to fight for survival. From now on, there will be three major players on the market who can offer subscribers a bundle of “mobile communication + broadband Internet access + television at a favorable price.” And their arrival in the segment of optical Internet using PON technology will only increase the degree of competition – especially in the private sector. I expect the most interesting marketing solutions in the regions where there is Volya and a concentration of lifecell subscribers,” Glushchenko explains.

Anatoly Frolenkov adds that for the French, the purchase of “Datagroup-Volia” is part of the development strategy, especially in the O2O segment (on the inter-operator / trunk market). That is why NJJ Capital is also buying the Ukrtower company from Turkcell, which leases towers to operators. ” The French love convergent solutions. Continuing the strategy of Polish Play and its other operators, they are very interested in strengthening their position in the fixed market. And in Ukraine, there are not so many assets that pass and meet the standards of international audit companies , “explains the expert.

What does everyone at lifecell think about this? “Of course, the merger of mobile and fixed operators should strengthen the position of companies in the market, because it will give the opportunity to provide a full range of services to customers, increasing efficiency through the shared use of infrastructure and gaining a competitive advantage through package offers. However, all these advantages can be achieved only through competent process management. In recent years, lifecell has been showing constant growth in both its subscriber base and key financial indicators (we are not talking about the beginning of a full-scale invasion, this period is an exception). Any reorganizations and careless structural changes can have a negative impact, so this risk should be taken into account,” says lifecell.

But they add: “Since Mr. Xavier has clearly stated that he is buying lifecell at a very low price, we hope that this indicates his intention to actively invest in those regions where there are serious problems with 4G coverage and capacity. This will undoubtedly bring significant benefits for Ukrainians.”

What can be the amount of the deal? Experts do not risk naming the approximate price. A simple formula – we multiply the multiplier by EBITDA – does not work in this case. In addition to the factors of the war and the overdue deadline for Horizon Capital’s exit from the capital of Datagroup-Volia, the company’s credit obligations must also be taken into account: in 2021, the EBRD provided a $65 million loan for the acquisition of Volia and the modernization of the network. It is not known whether the company managed to pay this and previous debts.

Before the full-scale invasion, the asset was valued at approximately $200 million . “Then Datagroup wanted to buy both Kyivstar and Vodafone Ukraine.” Currently, the “blue” operator has slightly different concerns, and the “red” managed to acquire “Vega” and “Freenet”. Although I will not be surprised if Vodafone Ukraine is now interested in acquiring Datagroup-Volia. So for Horizon Capital, it could be a trump card in negotiations with the French,” explains Oleksandr Hlushchenko. However, he doubts that Horizon Capital managed to negotiate the “pre-war” $200 million: the price of war, unfortunately, is huge, the amount of the deal may drop to $100 million.

Source: https://mind.ua/