Russian oligarch Mykhailo Fridman is still the co-owner of Kyivstar. Can the country’s largest mobile operator become state-owned because of this?

At the end of July, the government nationalized “Sens Bank” , and a year ago the court seized the assets of “Morshinska” for UAH 53.4 million. Mykhailo Fridman, a native of Galicia, has only one big asset left in Ukraine – the Kyivstar mobile operator.

Just a few days after convoys of Russian tanks crossed the border of Ukraine, and rocket fire destroyed the first homes of Ukrainians, Friedman and his partners fell under Western sanctions due to their closeness to Putin . The Great War marked the beginning of the end of ownership of Ukrainian assets for the Russian oligarch, who had been in control of them since the 1990s.

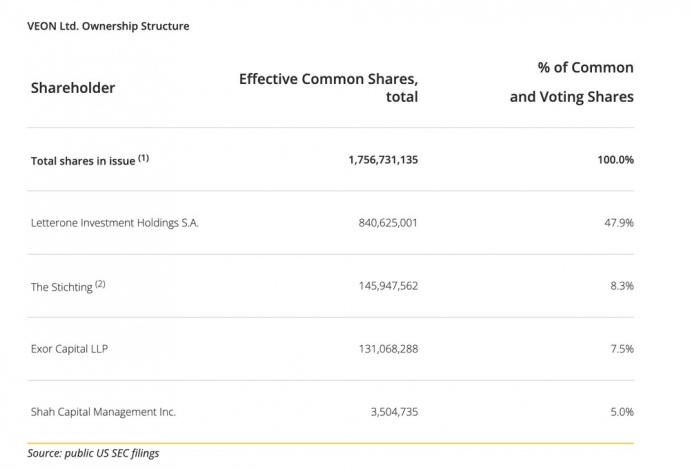

Friedman kept his last Horcrux safely hidden. Legally, Kyivstar is owned by the Dutch communication and technology company Veon Holdings B V. Its owner is Veom Amsterdam BV, which belongs to Veon Ltd. of Bermuda. The latter is 47.9% owned by LetterOne, in which 37.86% is owned by Fridman, and 47.23% by his partner Andrii Kosogov.

Today, the Ukrainian authorities are faced with a difficult task: to make sure that the assistants of the Putin regime can no longer make money from Ukrainians or develop their businesses in Ukraine, using jazz as a military bayonet.

The situation with “Kyivstar” is complicated due to the structure of the company’s owners. Veon shares are owned by investors from all over the world. By attacking the Russians, Ukraine may become a victim of its own actions, tarnishing itself with the status of an unreliable country for investment. Are there any options under which Ukraine can become the owner of the country’s largest mobile operator?

The beginning of “Kyivstar” and the appearance of “Alfa”

As an open joint-stock company “Kyivstar” was founded in 1994 by Ihor Lytovchenko, Oleksandr Chumak and Yurii Tumanov. Three years later, the first call was made in the network of the new mobile operator.

After that, “Kyivstar” was sarcastically called “Kuchmastar” for a long time due to family ties with the second president. The fact is that Yuriy Tumanov is the half-brother of Kuchma’s wife, and the daughter of the second president, Olena, once worked at the operator in the position of deputy director of marketing.

In the early years, the company did not have a developed technical infrastructure and a sufficient number of customers to finance its own development. Therefore, in 1998, it attracted a strategic foreign investor – the Norwegian telecommunications company Telenor, which received 38% of the shares of the Ukrainian operator. It was the Norwegians who began to introduce western standards of management and control in Kyivstar, which became the foundation for the growth of the mobile operator.

“Kyivstar”, in addition to Telenor, also attracted funds from other foreign and domestic investors. One of them was the Ukrainian company “Storm”, through which “Alfa-group” of Friedman just received the first share in the mobile operator.

The history of “Kyivstar” and Friedman began in 2002. Then “Alfa-group” bought 50.1% of “Storm” company. Telenor positively perceived the appearance of Russians in “Kyivstar”: in Russia they had a joint business – the mobile operator “Vympelcom” (Beeline).

In 2005, “Alfa” decided to firmly establish itself in the Ukrainian business and increased its share in “Storm” to 100%. Thus, “Kyivstar” was divided by Telenor and “Alfa-telecom” with shares of 56.5% and 43.5%, respectively.

However, the growth of “Kyivstar” will become a bone of contention between Telenor and the Russians in the future. The Norwegians included the results of the Ukrainian operator in their reporting because they owned most of its shares. Friedman noticed that the successes of the Ukrainian company affect the price of Telenor’s shares and proposed to fix the results of “Kyivstar” in half in order to use them in the corporate balance sheet. He was refused.

Another conflict between Telenor and “Alfa” arose due to the fact that in 2006, the latter introduced the Russian operator Beeline to the Ukrainian market (in 2009, it was absorbed by “Kyivstar”). The Norwegians did not support such a decision and the confrontation between the co-owners began to escalate.

Lockouts, corporate lawsuits in courts in four countries continued until 2008. Then, against the background of the financial crisis, the owners of “Kyivstar” realized that their rivalry was too expensive. The company’s accounts accumulated a net profit in the hryvnia equivalent of $2 billion. Due to constant conflicts between Telenor and Alfa, the board of directors did not meet for a long time, and when the dollar rate jumped sharply to UAH 8, everyone realized that the price of war was becoming obscenely high.

The compromise was the merger of the Russian “Vimpelcom” and “Kyivstar” into one company with Dutch registration Vimpelcom Ltd., which was later named Veon. By 2019, Friedman’s people finally won the war in Telenor for control of Kyivstar, buying the last shares of Veon from the Norwegians.

Thus, Friedman together with his partners became the largest owners of “Kyivstar” through the company Veon, in which Russians own 47.9% of shares. The rest of the shares are traded on the NASDAQ and Euronext exchanges, so thousands of people, including large investment funds, own them.

SOURCE: ANTI-CORRUPTION CENTER

The Great War, Friedman, “Kyivstar”

“Kyivstar” met the beginning of the great war in the status of a leader in terms of the number of subscribers – 26 million people. The main losses for the operator during the seventeen months of the war were the loss of subscribers, mainly those who migrated to EU countries and changed the operator due to roaming, occupation of the territory and destruction of equipment.

Interlocutors of the EP in the government note that the “Kyivstar” team demonstrated good work in difficult times, trying to keep the network operating in blackout conditions or quickly restoring communication in the de-occupied territories.

However, the Russians did not go anywhere and still own a significant share of the Ukrainian company, albeit with certain restrictions.

Friedman and his business partner Piotr Aven came under EU sanctions on February 28, 2022. The European regulator argued that Friedman is close to the Putin administration. In general, the founder of “Alfa-group” is under the sanctions of the EU, Switzerland, Canada, Great Britain, Australia, New Zealand and Ukraine.

Due to sanctions against Veon shareholders, the Dutch company began to complain about reputational damage. EU sanctions ultimately forced Friedman and Aven to leave the London-based investment group LetterOne, through which they owned Kyivstar.

Their shares are “frozen” with no rights as shareholders in terms of disposing of them and receiving dividends. While under sanctions, they cannot sell shares, and the board is not obliged to return their shareholder rights after the sanctions are lifted.

Friedman more than once called himself a victim of unjustified Western sanctions decisions. The interlocutor of the EP in the field of sanctions policy explained that it is difficult to convince the West to introduce sanctions against the Russian oligarchs, because the freezing of their assets has no effect on ending the war.

In the presence of Russians among the owners of “Kyivstar”, the interlocutors of the EP see two main problems in the authorities.

The first is that Russians make money from Ukrainians. In 2022, the income of “Kyivstar” increased by 8.2% to UAH 31 billion. According to the order of the National Bank of Ukraine, the company cannot withdraw dividends from the country, therefore all profits remain in Ukraine. However, after the end of the war, this restriction will be lifted, as will probably the sanctions of the West.

The second is safety. “Kyivstar” assures that Fridman has no influence on the work of the mobile operator. “There are no beneficial shareholders in the ownership structure of Kyivstar, i.e. persons who, as defined by the legislation of Ukraine, have a 25 percent share in the authorized capital and can exert a significant influence on the company’s economic activity,” the operator emphasizes.

However, potential risks remain. In addition, already during the Great War, “Kyivstar” purchased the Helsi medical service , which is used by about half of Ukrainians. In addition to patients, more than 50,000 doctors and 1,300 clinics are registered with Helsi. So, the service stores the data of the lion’s share of Ukrainian medicine.

Veon also owns the Russian mobile operator Vimpelcom (Beeline). Earlier, the Kommersant publication reported that Russian operators, including Beeline, at the request of the Ministry of Digital Affairs of the Russian Federation, reduced the prices for calls in the occupied territories of Ukraine. In general, “Vympelcom” defines calls in these regions as international, being wary of sanctions.

Currently, the owner of “Kyivstar” is trying to sell its Russian asset, and has already received permission from the sanctions division of the US Treasury Department.

Will “Kyivstar” be nationalized

In May 2022, a mechanism appeared , according to which Ukraine can not only freeze the Russian assets of persons subject to sanctions, but also confiscate them for its own benefit. For this purpose, the NSDC should create a list of individuals and legal entities that may be complicit in aggression, and impose sanctions on them.

Next, the Ministry of Justice analyzes the activities of each person on the NSDC list. The task of the Ministry of Justice is to find evidence of the involvement of sanctioned persons in crimes against Ukraine and send them to court with a statement on the need to confiscate assets.

After that, the High Anti-Corruption Court considers the statements of the Ministry of Justice and decides whether to confiscate Russian assets. In the case of a positive court decision, the government decides to whom to transfer the seized asset: to the Agency for Search and Asset Management, the State Property Fund, the military administration or another state entity.

On October 19, 2022, the president implemented the NSDC decision to impose sanctions on more than 250 businessmen, more than 1,500 companies and 4,000 propagandists. Friedman was also included in this list. It seemed that after that the fate of his assets in Ukraine was determined, however, as in the story with “Sens Bank”, not everything is so clear-cut.

First, “Kyivstar” is systemically important for national roaming, as it is the largest mobile operator in the country. The government notes that a certain balance between three companies has been formed on the market of mobile operators. Each operator covers the entire territory of the country, but it so happened that Vodafone had more subscribers in the east of Ukraine, and Kyivstar in the west.

The mechanism of the company’s transition to the state through the NSDC will take some time, and users may start switching to other operators en masse. However, Vodafone and Lifecell will not be able to accept even a third of “Kyivstar” subscribers. There may be a situation where everyone will be out of touch.

Secondly, the nationalization of Kyivstar creates reputational risks for Ukraine. Friedman is a major shareholder of LetterOne. The latter owns 47.9% of the shares of the Dutch Veon Holdings. The rest of Veon shares are owned by various investors.

“Ukraine has a valid bilateral agreement on the mutual protection of investments with the Netherlands, which prohibits the expropriation of assets, except when such expropriation takes place in accordance with the legal procedure for the purpose of protecting the public interest on a non-discriminatory basis with the provision of adequate and fair compensation of the value of the asset,” he explains Anna Vlasiuk, analyst of the Kyiv School of Economics, member of the Yermak-McFaul sanctions group.

According to her, even if Ukraine assures that the alienation of Friedman’s assets protects the public interest, the state will still have to pay compensation.

In addition, the nationalization of a company whose shares are traded on global stock exchanges will affect Ukraine’s investment attractiveness. If compared with “Sens Bank”, which Friedman owned through a Cypriot company, Ukraine and Cyprus do not have an agreement on mutual protection of investments. But even in spite of this, the Verkhovna Rada passed a special law for the nationalization of the bank.

According to the interlocutors of the EP in power, full nationalization options are not considered, a mechanism is being developed to alienate only Friedman’s share. This option also has difficulties, because Veon is under the jurisdiction of the Netherlands.

“It is difficult for Ukraine to force Veon to alienate Friedman’s share, because the ownership relations in the corporate structure take place in the jurisdiction where the company is registered. In this matter, it is necessary to turn to the EU. Acts should be adopted there, which would oblige companies to alienate shares belonging to sanctioned persons. However, this is considered unlikely,” Vlasyuk adds.

International examples

On January 4, 2022, the National Security and Investment Act came into force in Great Britain. It allows the government of that country to review the agreements for five years after their conclusion. Accordingly, the government ordered the sale of regional provider Upp, which was bought by LetterOne in 2021.

The Secretary of State for Business, Energy and Industrial Strategy, Grant Shepps, said Upp’s ownership of LetterOne was a “national security risk”. Obviously, such a decision was motivated by the presence among the owners of LetterOne, Friedman and Aven, who are under-sanctioned persons.

The government also used the law to block the purchase of HiLight Research by SiLight, a semiconductor manufacturer in Shanghai. Shepps said that HiLight technologies could threaten Britain’s national security.

A similar situation has developed in the USA around the TikTok social network. At the time, the government’s Foreign Investment Committee warned the social network’s leadership that if it kept TikTok shares with Chinese owners, the company would face a possible ban on operations in the United States. The main motive of the committee was that the application could be used by Chinese intelligence.

Source: https://www.epravda.com.ua/