This month, the investment company Shah Capital Management offered to take Kyivstar, the largest Ukrainian mobile operator, to the stock exchange or sell its share.

Shah Capital Management is an American company. She is a minority shareholder of the telecommunications holding Veon (Amsterdam), which owns Kyivstar. It owns 4.95% of the shares.

Let us remind you that the largest share of Veon — 47.9% — belongs to LetterOne . In turn, Russian oligarch Mykhailo Fridman and his long-time partner Aven Petr have a combined less than 50% stake in LetterOne.

Shah Capital Management explains in an open letter that Veon’s shares are now worth little — $19 a piece. And it is necessary to somehow increase their value. Ideally, up to $100. Therefore, the Kyivstar IPO is one of the parts of this plan.

Let’s find out if this is good advice from the American minority and, most importantly, how realistic it is now.

But first, let’s find out why shares of Veon (mother of “Kyivstar”) are worth so little.

What is wrong with Veon

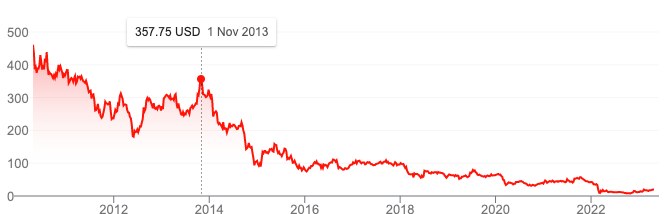

In fact, Veon has been losing its capitalization for more than a decade. If one share of the holding was worth $350 on NASDAQ in 2013, now it is $19.

So what’s the matter? Telecom is a profitable business with stable income.

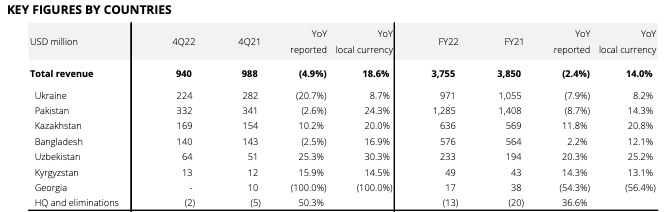

What is VEON in principle? This is a holding whose main market until recently was Russia. In 2022, the operator under its control earned $3.5 billion in the Russian Federation. This is only slightly less than what VEON earned in all its other markets of presence: Pakistan, Ukraine, Kazakhstan, Bangladesh, Uzbekistan, Kyrgyzstan, Georgia. Activity in all these markets for 2022 generated $3.7 billion.

So why isn’t VEON interesting to exchange players?

There are several reasons for this. Veon cannot influence some of them. For example, the telecommunications market itself. Unlike the market for, say, Internet startups, telecom is already a fairly mature field. Mobile networks are built all over the world. And it is unlikely that they can be greatly expanded. It is a completely different story with online services, the audience of which can grow quickly and suddenly. And this is always interesting to investors on the stock exchange.

In addition, telecom, unlike online services, has a clear regional connection. If you built a network in Bangladesh, you can’t quickly scale this service to the States. For that, you need to build a separate network from scratch. In the Internet business, the rules are completely different: you can immediately start globally and earn on the most profitable markets.

It so happened that Veon works in markets with a low income level of the population, which is not able to pay a lot for communication.

The holding has repeatedly tried to transform itself into a more digital business. But its main business is still telecom.

Another feature of telecom is that it constantly needs investment. Yes, you can have a high margin, but each next generation of the network — 3G, 4G, 5G — requires, first, the purchase of a frequency license from the state (this is, as a rule, an auction). Secondly, this is a constant upgrade of the network — it is necessary to change the radio equipment, the network core, and other things.

Therefore, the investment will eat up the margin. And even worse, they put the holding in debt. In 2021, Veon’s total debt was more than $8 billion. But in the 2022 report, it showed only $4.5 billion. And this is only because this time the holding did not count Russian debt. Because Veon took the Russian Beeline out of reporting — it wants to sell it before the beginning of summer.

Of course, the presence of such a huge Russian asset does not add to the company’s capitalization either. Because Russian business is toxic for investors.

What insiders say about Kyivstar IPO

On the condition of anonymity, we managed to communicate with one of the top managers of the company, which is part of the Veon group. He calls the American investor, who proposed to take Kyivstar to the stock exchange, aggressive.

“It was a surprise for Veon, especially since the letter was open. And everyone could watch it,” says our interlocutor.

But he adds that the idea of listing Kyivstar on the stock exchange is also being considered within the holding. It looks logical. “Because there is an opportunity to buy Ukraine itself, and not all the businesses of the holding,” the top manager emphasizes.

According to him, the idea will not work now, when the war is going on. But after it ends, it is a real prospect with a good prognosis.

What analysts say

The most interesting question: will “Kyivstar” cost separately more than Veon?

The short answer is yes. But the premium will obviously not be significant. “If after the war, then theoretically it will be possible to talk about a premium due to the prospects of faster growth. But the premium is unlikely to be more than 25-30%,” comments Oleksandr Paraschy, head of Concorde Capital’s analytical department.

“Obviously, there is an opinion that an individual company can be worth much more than as part of a holding. There are also such options – at one time, for example, PayPal separated from Ebay. But it is a completely normal situation. Here, of course, there is also the issue of war and sanctions, and not just the economy,” adds Mykhailo Demkiv, Financial Analyst of the ICU Group.

How much can “Kyivstar” cost

“Unfortunately, I do not have an estimate of the potential value of the company. But according to VEON, the EBITDA for the Ukraine segment (that is, Kyivstar) amounted to $575 million in 2022. I think the value of the company should be at least 1.5–2 times this indicator,” says Demkiv. That is, the estimate of the mobile operator may be at the level of $862.5–1150 million.

It must be said that such a figure looks quite good, against the background of the amount of the deal, for which the Azerbaijani holding NEQSOL bought in 2019 the second player on the market — Vodafone Ukraine. There was no war then, but the operator got it for $734 million. The company’s OIBDA was then $322 million for the year. Therefore, the OIBDA multiplier relative to the price of the slav deal is then 2.3.

This is one extop manager in the mobile business, who gives a lower potential valuation of Kyivstar if they try to sell it right now — a maximum of $600 million minus debt.

“But, to be honest, there is simply no price for today’s situation. The discount can be any. No one knows how, what and where the war will end,” he emphasizes.

So, the following conclusion can be drawn: if Kyivstar is listed on the stock exchange, then only after the war. And it can actually cost more.

Source: